New Calculators to Assist Mineral Owners and Landmen

Berlin wanted to advise you that we have recently added two calculators to our website that will be useful to Oklahoma oil and gas mineral owners and landmen. They can be found by clicking here…

All,

Berlin wanted to advise you that we have recently added two calculators to our website that will be useful to Oklahoma oil and gas mineral owners and petroleum landmen. They can be found by clicking here.

Did anyone else’s grandfather utilize one of these bad boys? Berlin’s new calculators are not this cool.

-The first tool allows a user to determine net mineral acreage using a net revenue interest decimal from a check stub. This calculator is useful to both mineral owners and mineral buyers for a quick, back of the envelope calculation of net acreage owned (at least in the wellbore).

-The second tool allows a user to determine a working interest decimal in a multi-unit well. This calculator is useful to landmen who need to calculate both operated and non-operated working interest decimals when an allocation factor will need to be applied. Completed for production costs will also be automatically calculated if an AFE figure is entered. Please be careful as there is nothing in this calculator to prevent a user from entering a total allocation greater than 100%.

Berlin is currently working on a document stamps back-in to purchase price calculator among others.

Please contact Berlin if there are any other calculators you would like to see added to the site. We hate opening up excel and typing the same formulas over and over again and we are certain that is the case for some of y’all as well.

More to follow,

Berlin

Reversionary Mineral Interests: The Term Mineral Deed

Oklahoma Oil and Gas Mineral Owners,

Today, Berlin was approached by a fellow oil and gas royalty owner (let's call him Bruce) who needed some assistance as he just received an unexpected division order in his mailbox (nice problem to have by the way). After some researching we found that his father conveyed his Carter County, Oklahoma minerals via a term mineral deed fifty years ago. A term mineral deed is a type of reversionary interest. According to Black's the definition of reversion is:

In real property law, a reversion is the residue of an estate left by operation of law in the grantor or his heirs, or in the heirs of a testator, commencing in possession on the determination of a particular estate granted or devised.

And a reversionary interest is:

The interest which a person has in the reversion of lands or other property. A right to the future enjoyment of property, at present in the possession or occupation of another.

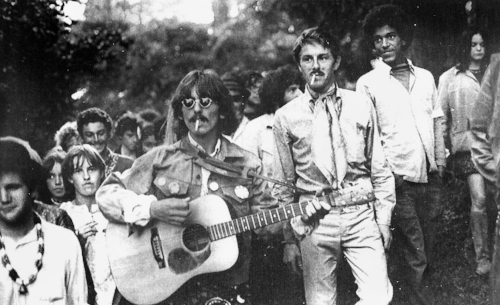

Bruce's father with the tie and cigarette. He sold his Oklahoma mineral rights on a term mineral deed to finance his "Summer of Love" exploits. The man knew how to smoke.

In landman terms, this just means that the property in question will automatically go back to the original grantor or the successors of that grantor's interest to the property when a certain condition is met. The conditions could include such mechanisms as a back in, an overriding royalty interest to working interest option and others which Berlin will cover at a later date. This reversionary interest in question today was simply a term that was written into a mineral deed.

Terms are very common in the oil and gas business. The most common instrument with a term is the oil and gas lease. However, conveyances of a fee mineral interest can also contain a term and that is what Bruce owned. Long story short, Bruce's father conveyed his minerals to a grantee in 1967 for a term of 50 years. Occasionally, the term of a term mineral deed may be perpetuated by production, but that was not the case here. Simply put, the minerals rights owned by Bruce's father would revert to his heirs (if they were conveyed the reversionary rights) 50 years to the day from the original effective date of the conveyance.

Often, reversionary interests with longer terms are lost in the inter-generational shuffle of heirs. In this case, Bruce is fortunate that the attorney who originally rendered the title opinion for the operator made a note of this term instrument so the operator was able to track it through the years. Bruce is also lucky that the operator of the lease had drilled the original well in the 1970s and continues to operate the lease to the present day. This is uncommon.

If you have any further questions about reversionary or term instruments and your Oklahoma mineral rights, or you would like to discuss selling your mineral rights or oil and gas royalties (with or without a term) please contact Berlin or comment below.

More to follow,

Berlin

Ready to Sell?

Request your No Cost, No Obligation Offer to Trade or Sell Your Oklahoma Mineral Rights and Oil and Gas Royalties by Clicking Here or Calling Berlin Royalties at 918.984.1645