A Well Proposal In Oklahoma - A Boon to the Mailman

Berlin's friend Bruce called her up on Friday, and after he finished ranting about planting his tomatoes before the last frost date, he got down to asking about well proposals and why he is receiving them in the mail for his Pittsburg County, Oklahoma mineral rights…

Oklahoma Oil and Gas Mineral Owners,

Berlin's friend Bruce called her up on Friday, and after he finished ranting about planting his tomatoes before the last frost date, he got down to asking about well proposals and why he is receiving them in the mail for his Pittsburg County, Oklahoma mineral rights.

Unless one is party to a Joint Operating Agreement, a well proposal in Oklahoma is a non-binding piece of correspondence. It is supposed to be the last of a series of efforts for all owners with the right to drill a well in a certain drilling and spacing unit to agree to drill (or not to drill) that well before a forced pooling proceeding is undertaken at the Oklahoma Corporation Commission.

A well proposal will usually contain the following pieces of information;

- The proposing party (and potential operator)

- The location of the well (usually described to a quarter section level)

- The target formation

- The type of well (horizontal or vertical)

- The depth of the well

- The cost of the well (an AFE should be included)

- The proposed farmout/lease terms in lieu of participation in the well

Ever since our friends at Chesapeake popularized not sending out a JOA even between parties who have agreed to the development of a unit, a well proposal should be viewed as a warning order that a forced pooling application will arrive in a few weeks.

Dr. Evil prefers that one forgets that elections under a pre-pooling well proposal are non-binding so he can deem Austin out of the well.

There is little room for negotiation in the terms of the well proposal. If an owner desires not to participate and would prefer to lease/farmout and doesn't like the terms presented in the proposal, the proposing party will say something like, "well, you had your chance hot shot, but now you'll just have to see what we testify to at the pooling hearing." The power of the forced pooling provisions gives her the ability to (1) call anyone she wants "hot shot," and (2) not care about responding to counter-proposals from other owners in the unit. Berlin has been told that is not the case in other states (property rights, who needs property rights?).

If an owner does want to participate in the well, he will still have to elect to do some when the forced pooling order issues. Despite the fact this is usually written into the well proposal, many parties still fail to elect under the order and the operator is more than happy to overlook their previously designated intent and deem them out of the well.

After Berlin explained these facts to Bruce, he asked the only questions that a reasonable person would ask after hearing about how worthless a pre-pooling Oklahoma well proposal is, "what's the point and who benefits?" Berlin isn't sure what the point of the well proposal is, they are often ambiguous and as stated above, non-binding. The beneficiaries are certainly the USPS who really enjoy when letters are sent certified at $7.00/piece and the potential operator's competition who get a 2-3 week notice that applications are about to be filed.

Please comment below or contact Berlin with any more questions about well proposals or if you would like to sell your Oklahoma mineral rights.

More to follow,

Berlin

Splitting the Baby and the Pooling Bonus

The Oklahoma Corporation Commission has been regulating on the fly as to rule changes on multi-unit horizontal wells. One of the recent changes is that applicants now must offer a formation election if the applicant desires to force pool more than one common source of supply. Berlin thinks that this effects the unleased Oklahoma mineral owner more than the commissioners had originally intended...

Oklahoma Oil and Gas Mineral Owners:

The Oklahoma Corporation Commission has been regulating on the fly as to rule changes on multi-unit horizontal wells. One of the recent changes is that applicants now must offer a formation election if the applicant desires to force pool more than one common source of supply. Berlin thinks that this effects the unleased Oklahoma mineral owner more than the commissioners had originally intended.

Your call Sol...splitting the pooling bonus for the Oklahoma oil and gas mineral owners.

Old World for the Mineral Owner:

The Commission effectively put a stop to applicants pooling from the surface to granite, instead allowing the the applicant to only pool her target formation and the formation directly uphole and directly downhole. For example, if the applicant proposed a Woodford well, she would have been allowed to pool the Mississippian, Woodford, and Hunton. For simplicity's sake, if my man Bruce was an unleased Oklahoma mineral owner and did not want to participate in the Woodford well with his 10 net mineral acres, he would elect out of the initial well and thus have given up his ability to participate in any Mississippian, Woodford, or Hunton wells while the forced pooling order was in effect. If the only option in lieu of participation was $1,200 per net mineral acre and a 3/16 royalty, Bruce would receive $12,000 from the applicant.

New World for the Mineral Owner:

The situation has now changed with formation elections. The applicant now has to testify to the perspective value of a well in each formation she expects to pool in order to proportionally allocate the bonus amount. If she testifies that the Mississippian, Woodford, and Hunton are equally perspective, they would receive 1/3 of the allocated bonus each. Now if Bruce elects not to participate in the drilling of the initial Woodford well, he will only receive $4,000 from the applicant ($1,200/nma * (1/3) * 10). If the applicant does not propose a Mississippian or Hunton well during the primary term of the forced pooling order, Bruce will never have an opportunity to make an election and thus will never be compensated for his Mississippian and Hunton formations being pooled for a year.

Now many of you will shout "Berlin, you're a goon, Bruce's Mississippian and Hunton will be open after the primary term of the order." And that is true. Bruce will most likely be open in a year where he could lease or even propose his own well. But Berlin would argue that after a horizontal operator has drilled a Woodford well in the unit, the chances of another operator paying Bruce a premium for his Mississippian and Hunton rights would be unlikely unless better wells are eventually made in the the Mississippian or Hunton.

As there are pros and cons to formation elections for the Oklahoma mineral owner, there are also pros and cons for the applicant/operator. Pro: Her pooling bonus will be lower in the short term, in the case above 1/3 of what it would have been under the old regime. This will be even more advantageous for the operator who is pooling (as opposed to leasing) a greater amount of acreage. Con: Many companies are now valued on their net acres in multiple formations. So now if the operator pools more acreage and initially only drills Woodford wells, her Mississippian acreage count will not see a benefit from the pooling proceedings. This should be somewhat intuitive, she didn't pay for it, she doesn't own it (unless she can convince a bigger fish with someone else's money to pay her for the Mississippian acreage if it is during the primary term of the pooling order).

Conclusion:

Berlin predicts that these rules will change at some point in the future and that an Oklahoma mineral owner will again be permitted to elect out of all formations held by the pooling order in order to receive 100% of the pooling bonus from the outset (TVM, even if they don't call it that...).

If you have any more questions on split bonus payments under Oklahoma Corporation Commission forced pooling orders or you would like to sell your Oklahoma mineral rights and royalties, please contact Berlin.

More to follow,

Berlin

Spudding Before Forced Pooling

Bruce was a bit pissed when he called up Berlin today. Apparently, his fence line weaning efforts cost him about 6 hours of sleep after he found the fence knocked down and the calves back with their mommas. After he calmed down a bit, he asked why so many operators are spudding their wells before a forced pooling order has issued and what his options are as an unleased Oklahoma oil and gas mineral owner named as a respondent in the pooling proceedings...

Oklahoma Oil and Gas Interest Owners:

Bruce was a bit pissed when he called up Berlin today. Apparently, his fence line weaning efforts cost him about 6 hours of sleep after he found the fence knocked down and the calves back with their mommas. After he calmed down a bit, he asked why so many operators are spudding their wells before a forced pooling order has issued and what his options are as an unleased Oklahoma oil and gas mineral owner named as a respondent in the pooling proceedings.

There are a few reasons why an Oklahoma operator might spud a well before an Oklahoma Corporation Commission ("OCC") forced pooling order is issued.

- As Berlin discussed yesterday, the OCC is short staffed and the review and issuance of orders is taking a substantial amount of time and in some cases up to 5 months after the pooling was recommended at the hearing. In order to feed the rig monster, operators must keep drilling their wells. After all, a pooling order is not needed to obtain a permit to drill.

- If a forced pooled unit is not formed and there is no Joint Operating Agreement or any other voluntary pooling of leasehold interest between the working interest owners in the unit, there is no mechanism to govern the development of the unit. One of the consequences of this action is that there are no mechanisms to handle costs. And if a fellow working interest owner can't pay his costs, the operator will not provide well info. In short, operators will spud a well without a forced pooling order so they will not have to share well information in the short term with their competitors.

- Forced poolings can be a time suck. Dealing with asinine requests on pre-pooling letter agreements, setting protest dates, and finally the protests themselves are often an exercise in busy work. If an operator has a high working interest in the spacing unit, she might just spud the well and file a pooling application in time to have the order issue before the division order title opinion needs to be rendered.

The rig monster never sleeps, but enjoys purchasing Oklahoma oil and gas mineral rights before a horizontal well is drilled. It increases his NRI and keeps his LPs happy.

The operator incurs a risk when he drills before a pooling order has issued. Hopefully, he has used the time to evaluate the well and if he's made a good well, to lease the offsetting acreage. However, if he had issues drilling or made a marginal well, he is in danger of owning 100% of the working interest as the other working interest parties will have scouted the well and will elect out of the unit when the pooling order issues at a later date. So what are Bruce's options as an Oklahoma oil and gas mineral owner? Once the order issues, he should read the order as it will contain the usual options, however, he should be more strategic as he will have more information available to him.

- If the operator has made a good well, Bruce's interest will now be substantially more valuable. Bruce could participate in the well if he has completed his diligence on the property and scouted the location. However, Berlin's recommendation is that only professional mineral owners should participate in wells. Still, his mineral interest should command a premium with non-op companies who have other people's money to spend. Bruce should be able to negotiate an oil and gas lease with better terms than those found in the forced pooling order.

- If the operated drilled a dud, it is unlikely that any non-op will seek Bruce out for his interest unless the non-op just wants to participate with a small amount of acreage in order to obtain well information. In this case, Bruce should just elect the option in lieu of participation under the pooling order that works best for he and his family's situation (ie does he need cash now to buy replacement heifers or maybe more royalty later if an operator decides to density the section).

Berlin hopes she answered Bruce's question. If you have any more questions about forced pooling, or you would like an offer to sell your Oklahoma oil and gas mineral rights. Please drop Berlin a line or comment below.

More to follow,

Berlin

Is $10 Actually the Bonus Per Acre?

Oklahoma Mineral Rights Owners,

Berlin received another call from Bruce today. He was angry and slightly confused. Bruce was sure that some fly-by-night lease flipper was fixin' to cheat him out of his lease bonus. The Duncan, Oklahoma based outfit had offered him $1,100 per net mineral acre for a 3 + 2, oil and gas lease at a 3/16 royalty for some of his granddaddy's minerals in Beckham County, Oklahoma, which Bruce accepted...

Oklahoma Mineral Rights Owners,

Berlin received another call from Bruce today. He was angry and slightly confused. Bruce was sure that some fly-by-night lease flipper was fixin' to cheat him out of his lease bonus. The Duncan, Oklahoma based outfit had offered him $1,100 per net mineral acre for a 3 + 2, oil and gas lease at a 3/16 royalty for some of his granddaddy's minerals in Beckham County, Oklahoma, which Bruce accepted.

No Oklahoma oil and gas mineral owner is getting jammed on ole girl's watch.

However, upon review of the lease, Bruce read the following statement "Witnesseth that the said Lessor, for and in consideration of Ten and more Dollars, cash in hand paid, the receipt of which is hereby acknowledged...do grant, demise, lease..." Bruce asked the buyer to replace the ten dollars with the actual bonus due and the buyer balked. Bruce asked Berlin if this was proper or if he was getting jammed.

Berlin told Bruce that this is the industry standard and that lessees of Oklahoma oil and gas leases do not place the actual bonus paid of record by writing it into the oil and gas lease. As long as Bruce was satisfied with the terms of payment, the "and more" of the consideration and granting clause that he was presented is legitimate.

Berlin has written about the terms of the basics of the oil and gas lease before, but if you have any more questions about an oil and gas lease or you are interested in leasing or selling your mineral rights please comment below or drop us a line.

More to follow,

Berlin

Reversionary Mineral Interests: The Term Mineral Deed

Oklahoma Oil and Gas Mineral Owners,

Today, Berlin was approached by a fellow oil and gas royalty owner (let's call him Bruce) who needed some assistance as he just received an unexpected division order in his mailbox (nice problem to have by the way). After some researching we found that his father conveyed his Carter County, Oklahoma minerals via a term mineral deed fifty years ago. A term mineral deed is a type of reversionary interest. According to Black's the definition of reversion is:

In real property law, a reversion is the residue of an estate left by operation of law in the grantor or his heirs, or in the heirs of a testator, commencing in possession on the determination of a particular estate granted or devised.

And a reversionary interest is:

The interest which a person has in the reversion of lands or other property. A right to the future enjoyment of property, at present in the possession or occupation of another.

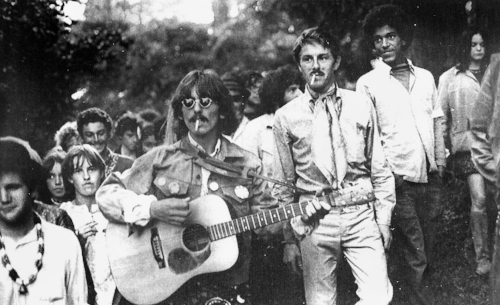

Bruce's father with the tie and cigarette. He sold his Oklahoma mineral rights on a term mineral deed to finance his "Summer of Love" exploits. The man knew how to smoke.

In landman terms, this just means that the property in question will automatically go back to the original grantor or the successors of that grantor's interest to the property when a certain condition is met. The conditions could include such mechanisms as a back in, an overriding royalty interest to working interest option and others which Berlin will cover at a later date. This reversionary interest in question today was simply a term that was written into a mineral deed.

Terms are very common in the oil and gas business. The most common instrument with a term is the oil and gas lease. However, conveyances of a fee mineral interest can also contain a term and that is what Bruce owned. Long story short, Bruce's father conveyed his minerals to a grantee in 1967 for a term of 50 years. Occasionally, the term of a term mineral deed may be perpetuated by production, but that was not the case here. Simply put, the minerals rights owned by Bruce's father would revert to his heirs (if they were conveyed the reversionary rights) 50 years to the day from the original effective date of the conveyance.

Often, reversionary interests with longer terms are lost in the inter-generational shuffle of heirs. In this case, Bruce is fortunate that the attorney who originally rendered the title opinion for the operator made a note of this term instrument so the operator was able to track it through the years. Bruce is also lucky that the operator of the lease had drilled the original well in the 1970s and continues to operate the lease to the present day. This is uncommon.

If you have any further questions about reversionary or term instruments and your Oklahoma mineral rights, or you would like to discuss selling your mineral rights or oil and gas royalties (with or without a term) please contact Berlin or comment below.

More to follow,

Berlin

Ready to Sell?

Request your No Cost, No Obligation Offer to Trade or Sell Your Oklahoma Mineral Rights and Oil and Gas Royalties by Clicking Here or Calling Berlin Royalties at 918.984.1645